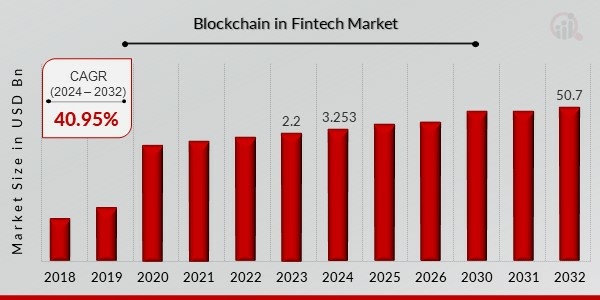

Blockchain in Fintech Market Projected for 40.95% CAGR, Reaching $50.7 Billion by 2032

Blockchain in Fintech Market Growth

Blockchain in Fintech Market Research Report Information By, Application, Provider, Organization Size, Industry Vertical, and Region

NE, UNITED STATES, April 9, 2025 /EINPresswire.com/ -- The global Blockchain in Fintech market has witnessed exponential growth in recent years and is set to accelerate further over the coming decade. In 2023, the market size was valued at USD 2.2 billion and is projected to grow from USD 3.2538 billion in 2024 to an impressive USD 50.7 billion by 2032, reflecting a remarkable compound annual growth rate (CAGR) of 40.95% during the forecast period (2024–2032). This surge is primarily driven by increasing demand for transparency, security, and automation in financial services, as well as the rapid integration of blockchain into payment systems, lending, and asset management.

Key Drivers of Market Growth

Enhanced Security and Fraud Prevention

Blockchain provides a decentralized and immutable ledger system that significantly reduces risks of fraud, data breaches, and cyberattacks. This is especially critical in fintech, where data integrity and secure transactions are paramount.

Efficiency in Payments and Settlements

The fintech industry is leveraging blockchain to streamline payments, reduce settlement times, and lower transaction fees. Blockchain enables real-time, cross-border payments without relying on intermediaries, driving efficiency and cost savings.

Rise of Decentralized Finance (DeFi)

DeFi platforms powered by blockchain are disrupting traditional financial systems by offering peer-to-peer lending, decentralized exchanges, and automated financial instruments. These innovations are expanding access to financial services and reducing reliance on traditional banks.

Smart Contracts and Automation

Smart contracts enable automated execution of financial agreements without third-party intervention. In fintech, this reduces operational costs, improves compliance, and enhances user experience through faster service delivery.

Regulatory Support and Digital Transformation

Governments and regulatory bodies are increasingly exploring blockchain frameworks and pilot programs to enhance financial transparency and traceability. The rise of digital banking and open finance models is further fueling the adoption of blockchain in fintech.

Download Sample Pages – https://www.marketresearchfuture.com/sample_request/6368

Key Companies in the Blockchain in Fintech Market Include

• AWS (US)

• IBM (US)

• Microsoft (US)

• Ripple (US)

• Chain (US)

• Earthport (UK)

• Bitfury (US)

• BTL Group (Canada)

• Oracle (US)

• Digital Asset Holdings (US)

• Circle (Ireland)

• Factom (US)

• AlphaPoint (US)

• Coinbase (US)

• Ava Labs (New York)

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/blockchain-fintech-market-6368

Market Segmentation

To offer a detailed perspective, the Blockchain in Fintech market is segmented based on application, provider type, organization size, and region.

1. By Application

• Payments and Remittances: Enables secure, real-time, and cost-efficient transfers.

• Smart Contracts: Automates transactions and compliance through coded agreements.

• Identity Verification: Improves KYC/AML processes through tamper-proof digital identities.

• Lending and Credit Scoring: Facilitates decentralized lending with transparent borrower data.

• Trading and Asset Tokenization: Converts real-world assets into digital tokens for easier trading and investment.

2. By Provider Type

• Application and Solution Providers: Deliver blockchain-based platforms and fintech apps.

• Middleware Providers: Offer integration tools connecting blockchain with fintech systems.

• Infrastructure and Protocol Providers: Develop the base-layer blockchain networks used by fintech firms.

3. By Organization Size

• Small and Medium Enterprises (SMEs): Leverage blockchain for cost-effective financial operations.

• Large Enterprises: Use blockchain to modernize infrastructure, enhance compliance, and support global operations.

4. By Region

• North America: Leads the market due to strong fintech ecosystem and regulatory innovation.

• Europe: Rapid adoption supported by favorable policies and investment in digital finance.

• Asia-Pacific: Fastest-growing region driven by government initiatives and rising tech adoption.

• Rest of the World (RoW): Emerging growth seen in Latin America, Africa, and the Middle East, especially in remittance-focused blockchain solutions.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=6368

The Blockchain in Fintech market is on an explosive growth trajectory, fueled by the global shift toward decentralized, secure, and transparent financial ecosystems. As the fintech industry continues to evolve, blockchain will remain at the core of innovation—transforming everything from digital payments to asset management. With increasing adoption across regions and expanding applications, blockchain is set to redefine the future of finance.

Related Report:

Fintech Lending Market

Bank Kiosk Market

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release