Sodium Channel Blockers Clinical Trial Pipeline Accelerates as 20+ Pharma Companies Rigorously Developing Drugs for Market Entry | DelveInsight

The sodium channel blocker market is expanding due to the increasing prevalence of neuropathic pain and the demand for more selective treatments like Nav1.7 and Nav1.8 inhibitors. Advances in drug discovery are enhancing selectivity, reducing side effects, and improving efficacy. Additionally, the rising incidence of cardiac arrhythmias continues to fuel the demand for antiarrhythmic agents. With ongoing research, more targeted and safer therapies are emerging, further strengthening market potential. These factors collectively contribute to sustained growth and innovation in this space.

/EIN News/ -- New York, USA, April 09, 2025 (GLOBE NEWSWIRE) -- Sodium Channel Blockers Clinical Trial Pipeline Accelerates as 20+ Pharma Companies Rigorously Developing Drugs for Market Entry | DelveInsight

The sodium channel blocker market is expanding due to the increasing prevalence of neuropathic pain and the demand for more selective treatments like Nav1.7 and Nav1.8 inhibitors. Advances in drug discovery are enhancing selectivity, reducing side effects, and improving efficacy. Additionally, the rising incidence of cardiac arrhythmias continues to fuel the demand for antiarrhythmic agents. With ongoing research, more targeted and safer therapies are emerging, further strengthening market potential. These factors collectively contribute to sustained growth and innovation in this space.

DelveInsight’s 'Sodium Channel Blockers Pipeline Insight 2025' report provides comprehensive global coverage of pipeline sodium channel blockers in various stages of clinical development, major pharmaceutical companies are working to advance the pipeline space and future growth potential of the sodium channel blockers pipeline domain.

Key Takeaways from the Sodium Channel Blockers Pipeline Report

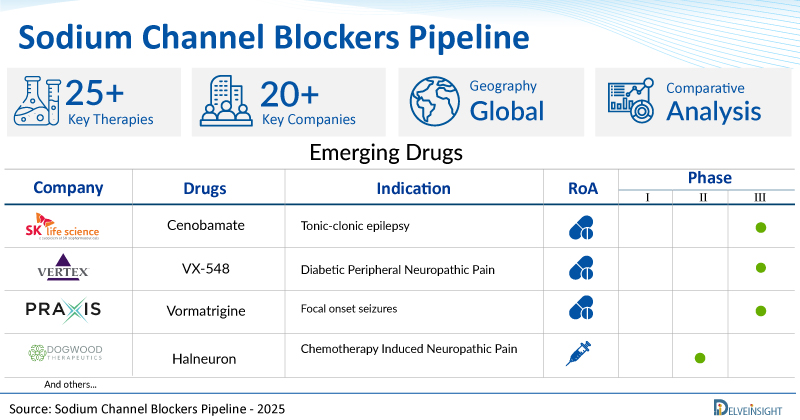

- DelveInsight’s sodium channel blockers pipeline report depicts a robust space with 20+ active players working to develop 25+ pipeline sodium channel blockers.

- Key sodium channel blocker companies, such as SK Biopharmaceuticals, Vertex Pharmaceuticals, Praxis Precision Medicines, Dogwood Therapeutics, Latigo Biotherapeutics, Neurocrine Biosciences, Channel Therapeutics, Newron Pharmaceuticals, RaQualia Pharma, Hisamitsu Pharmaceutical, Xenon Pharma, and others, are evaluating new sodium channel blocker drugs to improve the treatment landscape.

- Promising pipeline sodium channel blockers such as Cenobamate, VX-548, Vormatrigine, Halneuron, LTG-001, NBI-921355, CC 8464, Evenamide, RQ-00350215, Research Programme: Pain, and others are under different phases of sodium channel blocker clinical trials.

- In March 2025, the US Food and Drug Administration (FDA) granted fast-track designation (FTD) to LTG-001 for the treatment of acute pain.

- In October 2024, RaQualia Pharma Inc. was informed by Hisamitsu Pharmaceutical Co., Inc. that Hisamitsu Pharmaceutical had reached a development milestone with a transdermal patch containing a novel sodium channel blocker, RQ-00350215, which RaQalia licensed to Hisamitsu Pharmaceutical.

- In October 2024, Virios Therapeutics, Inc. and Wex Pharmaceuticals, Inc., a wholly owned subsidiary of CK Life Sciences, announced that Virios had entered into a definitive share exchange agreement with Sealbond Limited, an indirect parent of Wex, under which the companies will combine in an all-stock transaction. The combined company’s new name is Dogwood Therapeutics, Inc.

- In July 2024, Nocion Therapeutics presented data on the preclinical and clinical development of Taplucainium(Charged Sodium Channel Blocker) as a potential treatment for Chronic Cough. This data was presented at the London International Cough Symposium.

Request a sample and discover the recent advances in sodium channel blocker drugs @ Sodium Channel Blockers Pipeline Report

The sodium channel blockers pipeline report provides detailed profiles of pipeline assets, a comparative analysis of clinical and non-clinical stage sodium channel blocker drugs, inactive and dormant assets, a comprehensive assessment of driving and restraining factors, and an assessment of opportunities and risks in the sodium channel blocker clinical trial landscape.

Sodium Channel Blockers Overview

Sodium channel blockers are a class of drugs that inhibit the flow of sodium ions through voltage-gated sodium channels in nerve and muscle cells. By blocking these channels, these drugs reduce the rapid depolarization phase of action potentials, thereby decreasing neuronal excitability and cardiac conduction velocity. Sodium channel blockers are widely used in the treatment of various medical conditions, including cardiac arrhythmias, epilepsy, and neuropathic pain. In cardiology, they are classified under Vaughan-Williams Class I antiarrhythmics and further divided into three subgroups (IA, IB, and IC) based on their effects on action potential duration and sodium channel affinity. Examples include lidocaine (Class IB), quinidine (Class IA), and flecainide (Class IC), each having specific applications depending on the severity and type of arrhythmia.

Beyond their cardiac applications, sodium channel blockers play a critical role in neurology and pain management. They are commonly used as anticonvulsants to prevent seizures by stabilizing hyperexcitable neuronal membranes. Drugs like phenytoin, carbamazepine, and lamotrigine are effective in treating epilepsy by limiting repetitive neuronal firing. Additionally, sodium channel blockers are employed in the management of chronic pain conditions, such as neuropathic pain, where excessive nerve signaling contributes to discomfort. Local anesthetics like lidocaine and bupivacaine also work through sodium channel blockade to provide temporary pain relief by preventing nerve signal transmission. Due to their broad applications, sodium channel blockers remain an essential category of drugs in both acute and chronic disease management.

Find out more about sodium channel blocker drugs @ Sodium Channel Blockers Analysis

A snapshot of the Pipeline Sodium Channel Blockers Drugs mentioned in the report:

| Drugs | Company | Phase | Indication | RoA |

| Cenobamate | SK Biopharmaceuticals | III | Tonic-clonic epilepsy | Oral |

| VX-548 | Vertex Pharmaceuticals | III | Diabetic Peripheral Neuropathic Pain | Oral |

| Vormatrigine | Praxis Precision Medicines | II/III | Focal onset seizures | Oral |

| Halneuron | Dogwood therapeutics | II | Chemotherapy Induced Neuropathic Pain | Subcutaneous |

| LTG-001 | Latigo Biotherapeutics | II | Postoperative pain | Oral |

| NBI-921355 | Neurocrine Biosciences | I | Epilepsy | Unspecified route |

Learn more about the emerging sodium channel blockers @ Sodium Channel Blockers Clinical Trials

Sodium Channel Blockers Therapeutics Assessment

The sodium channel blockers pipeline report proffers an integral view of the emerging sodium channel blockers segmented by stage, product type, molecule type, and route of administration.

Scope of the Sodium Channel Blockers Pipeline Report

- Coverage: Global

- Therapeutic Assessment By Product Type: Mono, Combination, Mono/Combination

- Therapeutic Assessment By Clinical Stages: Discovery, Pre-clinical, Phase I, Phase II, Phase III

- Therapeutics Assessment By Route of Administration: Infusion, Intradermal, Intramuscular, Intranasal, Intravaginal, Oral, Parenteral, Subcutaneous, Topical

- Therapeutics Assessment By Molecule Type: Vaccines, Monoclonal antibody, Peptides, Polymer, Small molecule

- Key Sodium Channel Blockers Companies: SK Biopharmaceuticals, Vertex Pharmaceuticals, Praxis Precision Medicines, Dogwood Therapeutics, Latigo Biotherapeutics, Neurocrine Biosciences, Channel Therapeutics, Newron Pharmaceuticals, RaQualia Pharma, Hisamitsu Pharmaceutical, Xenon Pharma, and others

- Key Sodium Channel Blockers Pipeline Therapies: Cenobamate, VX-548, Vormatrigine, Halneuron, LTG-001, NBI-921355, CC 8464, Evenamide, RQ-00350215, Research Programme: Pain, and others

Dive deep into rich insights for new sodium channel blockers, visit @ Sodium Channel Blockers Drugs

Table of Contents

| 1. | Sodium Channel Blockers Pipeline Report Introduction |

| 2. | Sodium Channel Blockers Pipeline Report Executive Summary |

| 3. | Sodium Channel Blockers Pipeline: Overview |

| 4. | Analytical Perspective In-depth Commercial Assessment |

| 5. | Sodium Channel Blockers Clinical Trial Therapeutics |

| 6. | Sodium Channel Blockers Pipeline: Late-Stage Products (Pre-registration) |

| 7. | Sodium Channel Blockers Pipeline: Late-Stage Products (Phase III) |

| 8. | Sodium Channel Blockers Pipeline: Mid-Stage Products (Phase II) |

| 9. | Sodium Channel Blockers Pipeline: Early-Stage Products (Phase I) |

| 10. | Sodium Channel Blockers Pipeline Therapeutics Assessment |

| 11. | Inactive Products in the Sodium Channel Blockers Pipeline |

| 12. | Company-University Collaborations (Licensing/Partnering) Analysis |

| 13. | Key Companies |

| 14. | Key Products in the Sodium Channel Blockers Pipeline |

| 15. | Unmet Needs |

| 16. | Market Drivers and Barriers |

| 17. | Future Perspectives and Conclusion |

| 18. | Analyst Views |

| 19. | Appendix |

For further information on the sodium channel blockers pipeline therapeutics, reach out @ Sodium Channel Blockers Therapeutics

Related Reports

Epilepsy Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key epilepsy companies including Xenon Pharmaceuticals, Aquestive Therapeutics, Atnahs Pharma (Pharmanovia), Takeda, Ovid Therapeutics, SK Biopharmaceuticals (SK Life Science), Eisai, Biohaven Pharmaceuticals, Knopp Biosciences, UCB Pharma, Alexza Pharmaceuticals, Idorsia Pharmaceuticals, Neurocrine Biosciences, Equilibre Biopharmaceuticals, among others.

Epilepsy Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key epilepsy companies, including Alexza Pharmaceuticals, Xenon Pharmaceuticals, GW Pharmaceuticals, Equilibre Biopharmaceuticals, Takeda Pharmaceuticals, Abide therapeutics, Otsuka pharmaceutical, H. Lundbeck A/S, Spark Therapeutics, Equilibre Biopharmaceuticals, ES Therapeutics, Supernus Pharmaceuticals, Inc., MGC Pharmaceuticals, Engrail Therapeutics INC, SK biopharmaceuticals, Longboard Pharmaceuticals, Janssen Research & Development, LLC, Equilibre Biopharmaceuticals, Cerevel Therapeutics, LLC, Neurona Therapeutics, Praxis Precision Medicines, UCB Pharma, Receptor Life Sciences, NeuroPro Therapeutics, Inc., Avicanna, Amring Pharmaceuticals Inc., Ovid Therapeutics, Addex Therapeutics, IAMA Therapeutics, CODA Biotherapeutics, Cerebral Therapeutics, Engrail Therapeutics, among others.

Refractory Epilepsy Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key refractory epilepsy companies including Eisai Co.LTD., Alexza Pharmaceuticals, Xenon Pharmaceuticals, among others.

Partial Epilepsy Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key partial epilepsy companies, including GW Pharmaceuticals, Equilibre Biopharmaceuticals, among others.

Refractory Epilepsy Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key refractory epilepsy companies, including Eisai Co.LTD., Alexza Pharmaceuticals, Xenon Pharmaceuticals, among others.

Partial Epilepsy Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key partial epilepsy companies, including GW Pharmaceuticals, Equilibre Biopharmaceuticals, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Consulting Services

Healthcare Conference Coverage

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant, and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance.

Contact Us

Shruti Thakur

info@delveinsight.com

+14699457679

www.delveinsight.com

Distribution channels: Banking, Finance & Investment Industry, Healthcare & Pharmaceuticals Industry, Media, Advertising & PR, Science ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release