America’s Aging Boom: How Reverse Mortgages Are Reshaping Retirement

With rising senior populations and home equity, reverse mortgages offer financial stability. Equity Access Group helps retirees unlock their home’s value.

LADERA RANCH, CA, UNITED STATES, March 14, 2025 /EINPresswire.com/ -- The United States is undergoing a significant demographic transformation, with a rapidly aging population, increased home equity among seniors, and rising financial concerns in retirement. These factors directly influence the demand for reverse mortgages, making them an essential financial tool for retirees looking to leverage their home equity for long-term financial security.

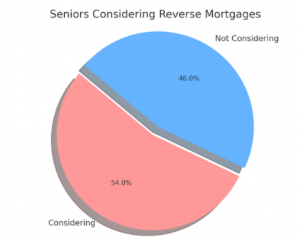

As more Americans reach retirement age, financial institutions adapt to meet their evolving needs. The reverse mortgage industry, in particular, is experiencing a shift as seniors seek innovative ways to supplement retirement income, cover healthcare expenses, and maintain financial independence.

Demographic Trends Influencing Reverse Mortgages:

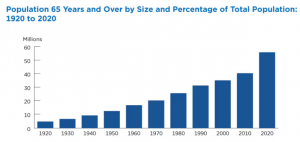

- Rapid Growth of the Senior Population: The U.S. population aged 65 and older grew from 55.8 million in 2020 to approximately 59.2 million in 2023, marking a 9.4% increase. This trend is expected to continue, with projections indicating that the number of Americans aged 65 and older will reach 82 million by 2050, comprising 23% of the total population.

- Increase in Centenarians: The number of Americans aged 100 and older is projected to more than quadruple over the next three decades, from an estimated 101,000 in 2024 to about 422,000 in 2054. (pewresearch.org)

- Rising Home Equity Among Seniors: Homeowners aged 62 and older saw their housing wealth increase by $600 billion in the second quarter of 2024, bringing the total to $14 trillion. (nrmlaonline.org)

Reverse Mortgage Market Dynamics:

- Market Size and Growth: The global reverse mortgage market was valued at approximately $1.93 billion in 2024 and is expected to reach $3.2 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.7%.

- Leading Lenders: As of July 2024, Mutual of Omaha Mortgage Inc. held the largest share of the U.S. reverse mortgage market at 22%, followed by Finance of America Reverse LLC.

- Interest Rate Influence: Fluctuations in interest rates have significantly impacted reverse mortgage market activity. In 2024, rising interest rates decreased home equity conversion mortgage (HECM) endorsements, while subsequent rate stabilization contributed to a market rebound.

Understanding Reverse Mortgages:

Reverse mortgages are financial products designed for homeowners aged 62 and older. They allow them to convert a portion of their home equity into cash. Unlike traditional mortgages, borrowers do not make monthly payments; instead, the loan balance grows over time and is typically repaid when the homeowner moves, sells the home, or passes away.

1. Types of Reverse Mortgages:

- Home Equity Conversion Mortgage (HECM): Federally insured by the FHA, the most common type of reverse mortgage.

- Proprietary Reverse Mortgages: Private loans for high-value homes, offering larger loan amounts than HECMs.

- Single-Purpose Reverse Mortgages: Offered by state and local governments for specific needs like home improvements or property taxes.

2. Benefits of Reverse Mortgages:

- Provides a steady income stream for retirees.

- Helps cover healthcare costs, home modifications, and living expenses.

- Allows seniors to stay in their homes without monthly mortgage payments.

3. Challenges and Considerations:

- Interest and fees accumulate over time, reducing home equity.

- Borrowers must maintain home insurance, property taxes, and upkeep.

- Not all seniors qualify, and eligibility depends on factors such as home value and existing mortgages.

As demographic trends highlight the increasing need for financial flexibility among retirees, reverse mortgages serve as a viable solution for many seniors seeking financial security.

About Equity Access Group:

Equity Access Group specializes in providing financial solutions tailored to the needs of retirees. Our mission is to help seniors achieve financial stability and peace of mind through products like reverse mortgages. EAG offers personalized consultations to help you understand the benefits and determine if a reverse mortgage is the right fit for your retirement plan.

Jason Nichols

Truss Financial Group

+1 888-391-4324

info@equityaccessgroup.com

Visit us on social media:

Facebook

YouTube

REVERSE MORTGAGES — an expert Mortgage Lender's BEST-KEPT SECRETS

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release